Debt Snowball vs Debt Avalanche: Which One is Better?

Written by

weFiIf you’re struggling to choose the best way to pay off debt, you’re not alone. Two of the most popular repayment strategies, the debt snowball and debt avalanche each offer a clear, step-by-step method to get out of debt. But they work in very different ways, and choosing the right one can impact your momentum, motivation, and savings.

In this guide, we’ll break down how each strategy works, how they differ, and which one may be better for you.

What Is the Debt Snowball Method?

The debt snowball approach focuses on paying off your smallest debt first, regardless of interest rate. You make minimum payments on all your other debts and throw as much extra money as possible at the smallest balance. Once that’s gone, you roll your payment into the next-smallest debt and so on, building speed like a snowball rolling downhill.

How It Works:

List debts from smallest to largest.

Pay minimums on all except the smallest.

Pay extra toward the smallest until it's gone.

Repeat with the next-smallest.

Best For:

People who need quick wins to stay motivated

Those who feel overwhelmed and want progress they can see

What Is the Debt Avalanche Method?

The debt avalanche focuses on paying off the highest-interest debt first, regardless of balance. It’s designed to minimize the total interest you pay and help you become debt-free faster at least mathematically.

How It Works:

List debts from highest to lowest interest rate.

Pay minimums on all, and target the highest-interest debt with any extra.

Once it’s paid, move to the next-highest interest rate.

Best For:

People who are motivated by saving money

Those comfortable playing the long game and less driven by quick wins

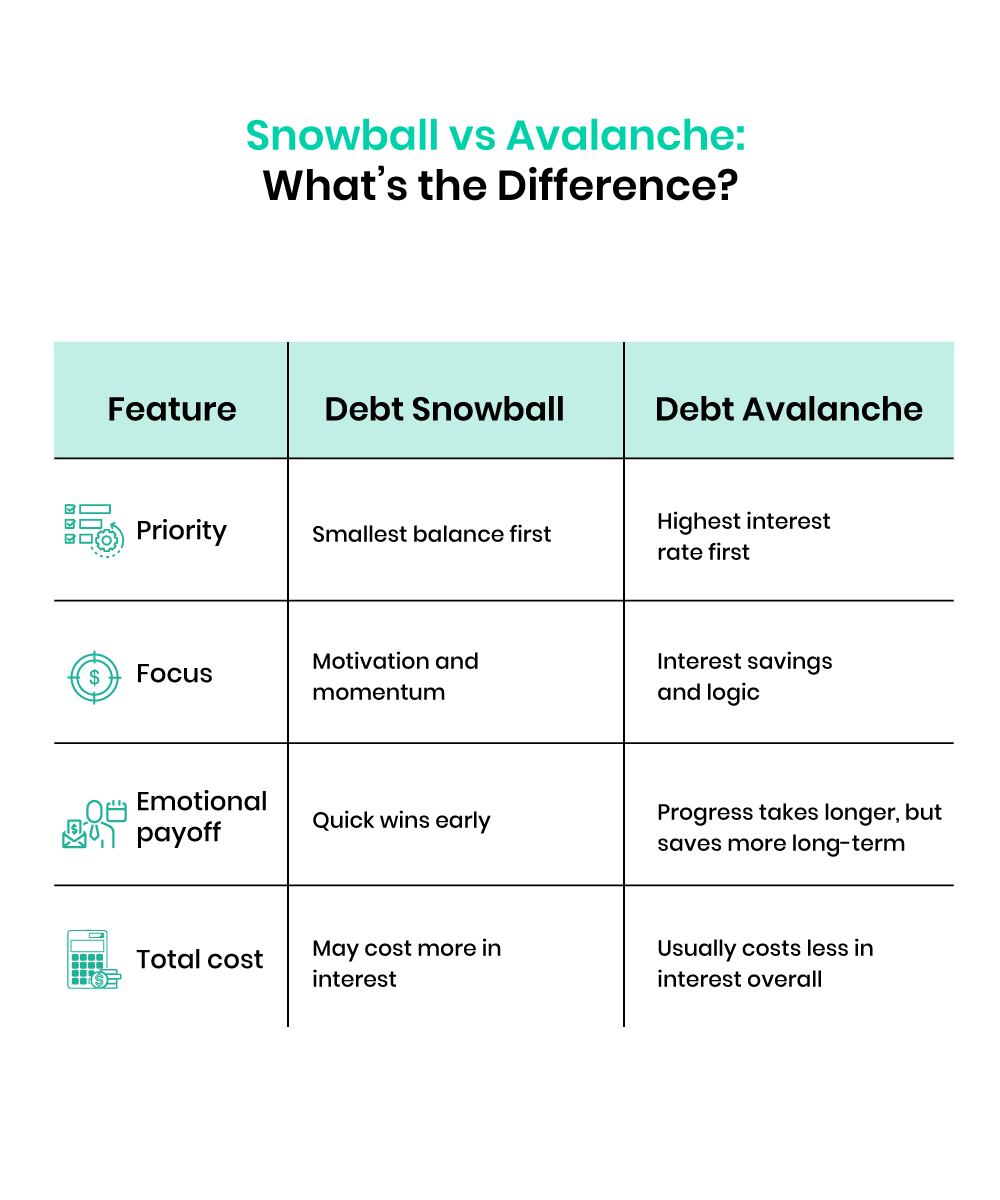

Snowball vs Avalanche: What’s the Difference?

Feature | Debt Snowball | Debt Avalanche |

Priority | Smallest balance first | Highest interest rate first |

Focus | Motivation and momentum | Interest savings and logic |

Emotional payoff | Quick wins early | Progress takes longer, but saves more long-term |

Total cost | May cost more in interest | Usually costs less in interest overall |

Why Psychology Plays a Role in Debt Repayment

When it comes to paying off debt, logic isn’t always the biggest motivator, emotion is. That’s why the debt snowball method works so well for many people. Paying off a small balance quickly delivers a mental win. That feeling of accomplishment fuels motivation and makes it easier to stick with the plan.

The avalanche method, while more cost-effective, often delays that first payoff moment. For someone who thrives on progress they can see, that delay can lead to discouragement even if they’re technically saving more.

The best repayment plan isn’t just about math. It’s about which strategy keeps you committed until the finish line.

Which One Is Better?

It depends on your personality and what will keep you committed.

According to a Harvard Business Review analysis of 1.4 million credit card users, individuals who focused their repayments on one balance at a time even if it wasn’t the highest-interest debt paid off more overall than those who spread payments across multiple accounts.

This behavioral pattern mirrors the debt snowball method, where small wins build momentum and improve long-term follow-through.

However, if you’re dealing with large, high-interest debts like credit cards or personal loans and you’re consistent, the avalanche method may save you hundreds or even thousands in interest over time.

How to Choose Your Strategy

Ask yourself:

Do I need early wins to stay on track? → Go Snowball

Am I comfortable delaying satisfaction to save money long-term? → Go Avalanche

Can I blend both methods? Absolutely.

Tip: Use a budgeting tool like weFi to track payments, automate plans, and stay on course.

Final Thoughts

Whether you choose the snowball or avalanche, the most important step is starting and sticking with it.

Both strategies work. What matters most is choosing the one you’ll stay committed to. Use tools like weFi to track your progress, stay motivated, and become debt-free on your terms.

Frequently Asked Questions

What’s the difference between debt snowball and debt avalanche?

The debt snowball method pays off the smallest balance first for quick wins, while the debt avalanche method targets the highest-interest debt first to save more money overall.

Which debt payoff method saves the most interest?

The avalanche method typically saves the most interest because it eliminates high-rate debts first—assuming you stay consistent with extra payments.

Why do people choose the debt snowball method?

Many borrowers pick the snowball method for the psychological boost of eliminating small balances quickly, which helps them stick to the plan.

Can I switch from debt snowball to avalanche?

Yes. You can start with the snowball method to build momentum and then switch to the avalanche method to minimize interest once disciplined.